Disney has been locked in a boardroom tussle with activist investor Nelson Peltz and his Trian Partners investor group.

Back in January 2023 Trian disclosed a significant stake in Disney, which eventually rose to about $3.5 billion. Ike Perlmutter, a former Marvel executive and longtime friend of Peltz joined the charge after being laid off from the group. Their aim, to reverse the slide at Disney.

They accused the corporate giant of being wasteful, with too high a cost base, focusing in the wrong places, and out of touch with customers’ demands. These included Disney’s high-profile DEI compliance. For context, Disney stock has dropped around 50% in the last two years.

The veteran activist investor claimed Iger’s current attempts to right the Disney ship were simply:

“…throwing spaghetti at the wall [to see what sticks]”

Peltz demanded Disney to cut costs and achieve “Netflix-like” profit margins in its streaming business and loudly criticized the “woke” movie strategy.

Peltz had urged shareholders to put him and former Disney executive Jay Rasulo on the board. In the process, this would deny seats to two current Disney directors – Michael Froman and Maria Lagomasino. A third player – Blackwells Capital – also put forward three nominees.

Disney stockholders are split, with about a third being what is known as “Retail” investors. That is people like you and me who just buy the stock for ourselves either because it had traditionally been a good investment, or as in a lot of cases, because they are enthusiasts of Disney theme parks, characters, and movies. So-called “Disney adults” who you see in the theme parks wearing the paraphernalia, Micky ears fitted as standard.

The rest are large, institutional investors such as pension funds, capital entities, and the ever-present Vanguard and BlackRock types.

So what happened? Blackwell’s stated aim was “keeping Nelson Peltz out of the Disney boardroom”. and their three nominees, while failing to get elected, split some of the votes so they would see it as job done.

Large institutional investors, and over half of the retail investors, backed Iger and the current board. This meant Trian and Peltz were defeated, garnering only 31% of the vote.

As a massive raising of a middle finger to Peltz and his group, Disney also chose to lead off the call, which was open to investors, by trumpeting a DEI policy and their achievements in this area.

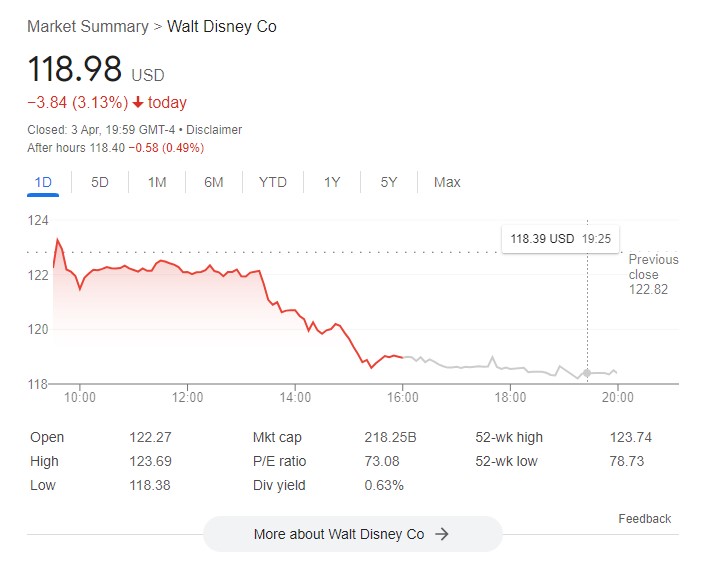

So as the results of the boardroom tussle became clear, how did the markets react?

Oh…

Check back every day for movie news and reviews at the Last Movie Outpost