A giant in the world of computer games, or the worst company in America? Either way, Electronic Arts (EA) has been struggling, and now it may be a target.

A lot of the publicity recently has been around EA going in for loot boxes, selling you a game for $70, then charging you via microtransactions for ongoing access to features, disgruntled employees, and a reputation for buying up dynamic, smaller rivals.

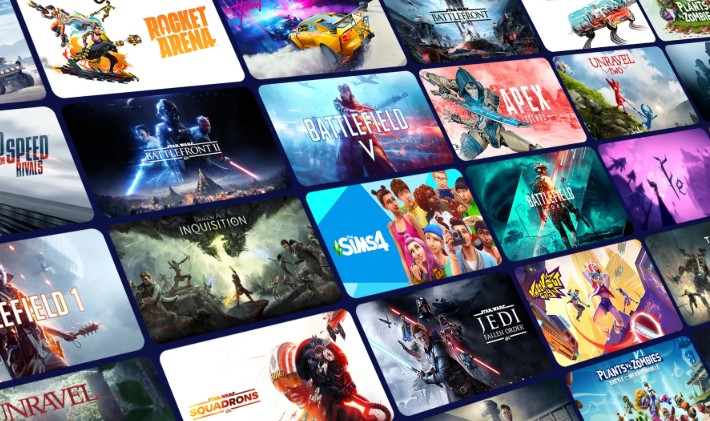

With a huge global footprint through titles like EA FC, as well as in some minority sports like Madden NFL and NBA Live, EA is seen as an attractive proposition. Other big-hitting franchises like Battlefield, The Sims, and Mass Effect point to a firm IP base.

So it is not surprising to find them now in the crosshairs of private equity.

According to The Wall Street Journal, a consortium is circling that includes Silver Lake, Saudi Arabia’s Public Investment Fund, and Jared Kushner’s Affinity Partners. The report values the firm at $50 billion and this would make it the largest leveraged buyout in history.

For context, the next in line are Energy Future Holdings (then TXU Corp.) in 2007 for $45 billion, Hospital Corporation of America (HCA) in 2006 for $33 billion, and Hilton Hotels in 2007 for $26 billion.

That’s a lot of Star Wars games.

With gamers increasingly hard-nosed about what they spend their money on, could new ownership be what the gaming giant needs to change things up a gear? The deal could go loud as early as next week. I just checked the share price, and the massive bump already happened. Too late again.